Price is what you pay. Value is what you get.

Warren Buffet

A college degree has always been perceived as being valuable.

Besides the prestige, it usually brings lower unemployment rates and higher wages. And many studies have been conducted like this one at the Washington Post, which states that “Going to college is worth it – even if you drop out”! They reinforce the notion that over one’s lifetime a college degree is worth dramatically more to the recipient, than not graduating college. But is it?

Parents will intuitively send their children to the best schools they can get into that is affordable. And even on the question of affordability, parents and students, have been willing to pile on debt to afford more expensive schools because of the perceived benefits of that college degree. So, over $1 Trillion is owed by families as they have made these investments in higher education.

Do these investments make sense? Are the perceptions of value borne out?

Unfortunately, the reality may be starker than you have been led to believe. Often, the investment you are making in that college degree may not be worth it.

Let me explain why, and show you how you can make more fact-based and logical choices, so that your investment in education does end up being valuable.

Don’t read the headlines. Those studies are wrong!

Many studies that show how much more money you earn because of earning a college degree are flawed. They are simplistic and not based on the underlying economic fundamentals of the choice and other reasonable alternatives. Several studies are so simple, they don’t even adjust for the fact that you will work fewer years, while attending college. Worse, “Time value of money,” the most basic of financial truths is completely ignored in their evaluation, and the conclusion is ultimately wrong.

Many studies that show how much more money you earn because of earning a college degree are flawed. Please Click To TweetHow should you view the investment in a college degree to figure it’s ultimate worth? Well, quite simply, in choosing to attend college, you give up the option of working after High School, and you will pay fees while in college. The payoff is that, upon graduation with your college degree, you will receive a higher salary than is being earned by the high school graduate. You would like to see that over the lifetime of your employment, the incremental wages you earn by attending college, would more than offset the fees you paid and the wages you could have earned while attending college.

Those studies use these factors to show that on average total wages earned by a college graduate, over their lifetime do exceed what is earned by the average high school graduate.

Where do they go wrong?

Simple, they fail to adjust for the fact that a dollar today is actually worth more than a dollar tomorrow, “The time value of money.”

You see, every investor knows that you should not just watch the cash inflows and outflows without looking at when they occur and adjusting them for real worth over time. You inherently know that no one will lend you $1,000 today, and ask for you to pay them back $1,000 five or ten years from now. That is because you know that the $1,000 should earn some interest and you would expect to get back more than just $1,000. So we need to take those future earnings and adjust them for the “Time value of money.”

Further, you don’t get to keep all those incremental wages. The government takes some of it in taxes. Thus, a failure by those studies to reflect tax differences and the time value of money lead to fatally flawed conclusions.

The right way to evaluate College Degree investments

Let’s look at an example and show you the difference:

According to the Bureau of Labor and Statistics, in Q3 2012, The median wage earned by a High School graduate was $648 per week, while the median earned for a college graduate was $1,071 per week. Between Q1 2002 and Q3 2012, both those wages increased by 1.97% per year on average. So let’s assume wages are increasing each year in both categories at approximately 2%. For simplicity, let’s assume someone leaving High School now has a choice of the $648 per week ($33,700 per year), or emerging four years later from college into the workforce and earning slightly higher $1,159 per week ($1,071 adjusted for wage inflation of 2% per year, or $60,270 per year). The National Center for Education Statistics indicates that the average fees paid in a private institution last year were $32,900 and that prices have been increasing at 5.6% per year over the last decade, so let’s assume that’s what our college student will pay.

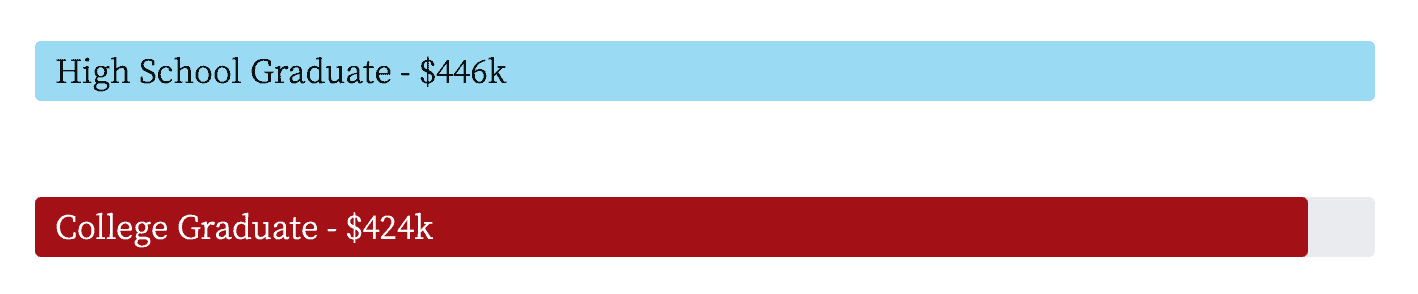

Lifetime Earnings (Absolute dollars earned assuming retirement at Age 65):

This is clearly the study that everyone uses to promote the idea that a college degree is worth it, after all, you earn $1.3M more over your lifetime.

But, what happens if we adjust those inflows and outflows, over the more than 40 years of payments and earnings, for the time value of money? The federal student loan rate is for direct loans is at 7.8% so let’s adjust all the cash flow each year using this discount rate. This is called the net present value (NPV).

NPV of Lifetime Earnings (Assuming retirement at Age 65):

What is happening here? Well, in trading off earlier wages, and paying to do so, you have to earn that much more in later years to compensate for those.

And it gets worse. If we adjust for taxes and then discount for the time value of money, this is what that comparison looks like:

After-Tax NPV of Lifetime Earnings (Assuming retirement at Age 65):

We used the 2012 Federal Tax Rate Structure for a single individual, including $5,950 standard deduction, $3,800 personal exemption, 4.2% Social Security and 1.45% Medicare applied to a maximum of $106,800 annual wages. No state or local taxes were assumed.

The result, is an investment that is actually economically worse than the alternative. The effect of taxes on wages and the time value of money together makes, what on an absolute basis seems like a great deal, a very bad economic decision.

Clearly, if you can pay less than was assumed here for college, either by going to a less expensive institution or by getting grants to reduce your outlay; the college degree investment would improve.

What can you do?

The value of a college degree depends on the right combination of college selected, cost for attendance, and college major. It’s simple really, the less you pay for college, and the higher you get paid upon graduation, the better off you are. Get those wrong, and you end up with a decision that will cost you money. That is why we built a comparison tool to help you understand these choices and their implications financially. You can check it out by going to College.Compareer.com comparison tool.

The value of a college degree depends on the right combination of college selected, cost for attendance, and college major. Please Click To TweetOne last point. Our tax structure is a disincentive to earning more. It does not consider the sacrifices when a college student foregoes income or the investment you make in your college degree. We all have an obligation to get that fixed!

Our tax structure is a disincentive to earning more. Please Click To TweetWhat do you think? Add your views by commenting below!

point taken Leon.

Jeff, if a college degree does not provide an economic benefit, then there are all kinds of questions about how one gets that degree. The benefit might not be seen purely in salary terms, but the costs are real and should be managed appropriately. The tool was built to show what happens when engineering or another field is chosen, and you are right, those degrees make a huge difference in the value equation. The trick is to get above average grades, major in something that delivers above average salaries, and attend an institution where you can pay below average costs. Play with it, let me know what you think: http://www.college.compareer.com

Tracy, it depends on what you do with it. Just soaking up education as a sponge, makes someone more knowledgeable, but if they do nothing valuable with it, what is that worth? It’s the old question – if the tree falls in the forest, etc. more important, while all education may be inherently worth it, how it’s acquired makes a huge difference to the value equation!

It would be interesting to see this broken out by field of study. Engineering and Science majors likely make 2x or 3x many other degrees and have very low unemployment rates. Also, many 2-year trade degrees have high salaries and low unemployment rates as well. Of course, all of this assumes a college degree is solely for economic benefit, which is probably selling a college education short.

All education is worth it Leon